Cool Bathroom Ideas On A Budget

For those who are looking to get better at managing their finances, creating a budget is a great place to start. A budget can be applied to both your personal and professional finances, allowing both individuals and businesses to make better financial decisions in the long term.

When creating a budget, you have to take an in-depth, honest look at your expenses and make decisions on how to use your money. So, let's look at what a budget is composed of, how you create one of your own, and the ways in which a budget can help you reach your financial goals.

A budget is a spending plan you create based on income and expenses. It estimates how much money you will make over a certain timeframe and how you will spend it. Though it may seem like some kind of punishment, it's actually a plan that will be helpful in the long run.

Most budgets start with a plan on how you will spend your money on essential things like your rent or mortgage, utilities, and groceries. For a company, essential items would be mortgage and utility payments, but also employee salaries and accounting services. However, a budget can also include room for fun and events as well. Most people and companies budget monthly or yearly, but you can also budget quarterly or biannually as well.

What Is the Purpose of a Budget?

The purpose of a budget is to track how your bills are going to get paid, and then how much money you have left over to spend on other things. Writing down your income and expenses will give you a better idea of any potential changes you should make in your spending. Having a better handle on your spending will allow you to save and invest a part of your income.

By creating a budget, you can cover financial needs (and some of your wants), make sure bills are paid on time, lower any debt, and work towards higher financial goals.

Different Types of Budgets

There are several different types of budgets. Of course, there is the personal financial budget that individuals and families use to track their income and expenses. That helps them to keep things afloat for their household. Businesses, on the other hand, often use a variety of budgets to evaluate their spending and come up with strategies to maximize their assets and revenues.

One of those budgets is a master budget that combines a company's individual budgets to assess the business' health and performance. This budget looks at sales, operating expenses, assets, and revenue streams. Another budget that a business will use is an operating budget. That budget accounts for sales, production, labor cost, manufacturing and materials costs, overhead, and administrative expenses.

Main Components of a Budget

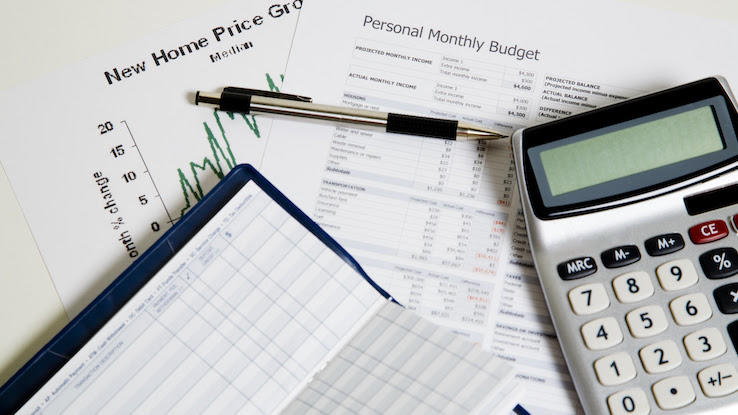

There are several different components to a budget. The two main components are income and expenses. For a personal budget, income includes take-home pay as well as any additional income from freelancing, alimony, and outside projects. For a business, management will look at sales and other assets.

Expenses for a personal budget specifically highlight essential spending as mentioned before but also discretionary spending like cable, takeout service, or going to the movies. A good budget should also include your projected expenses compared to what you actually spent.

Personal vs. Business Budgeting

As we've seen already, personal and business budgeting are fairly similar. Whether you're running a household of one or a company of 200, you need to be able to track where money is going. Both involve projecting income and expenses over a certain time period.

Budgeting for business looks at profits made within a given time period, while personal budgeting looks at savings and investments. With a corporate budget, forecasting revenue is absolutely vital to plan for the months ahead. It will let leaders set goals for the company in order to meet financial goals. In a bigger organization, multiple people will likely collaborate to provide input on the budget.

Why Is It Important to Budget?

Budgeting is vital to have a better relationship with your money. It puts you in control over your spending because it gives you a clear picture of how much money you have to spend or save. After taking a clear look at your budget (and subsequent purchases), you can spot where you may need to adjust your spending.

Getting this clear picture also helps you to be able to buckle down with savings or getting out of debt. If you have debt, you can look at your budget to help allocate more funds to pay that down. You can also adjust your budget to save money for an emergency fund. Unexpected expenses pop up all the time and you can handle them by having extra funds on standby. Best of all, budgeting also cuts down stress whether you're managing your finances with someone else or on your own.

How to Set Budgeting Goals

In order to create your goals from your budget, you will want to regularly evaluate that budget and consider new financial goals. In order to set proper goals, you should establish your short-term and long-term priorities in your life. You may want to put aside money for a vacation, a new car, or a down payment on a house.

Moreover, you may also consider money for your children's needs and education (if you have them or want them). Saving for retirement should also be a priority. Keeping those life goals in mind will help you be able to buckle down to establish a budget to help you accomplish them.

You should also consider your timeline of reaching these goals when establishing your budget. For example, if you want to cut down a certain amount of debt within a few years, you may need to put yourself on a tight budget to make that goal happen. Afterward, you may be able to loosen that budget up a bit to achieve your next big goal. Whatever your endgame, setting a budget — and sticking to it — can help you reach that next financial milestone.

MORE FROM ASKMONEY.COM

Cool Bathroom Ideas On A Budget

Source: https://www.askmoney.com/budgeting/components-of-a-budget?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Second, while both lines feature solid-wood doors, the Wood-Mode line uses furniture grade plywood for the boxes while Brookhaven uses particle board with the option to upgrade to plywood. If you've seen a Wood-Mode cabinet you know that there is a beautiful maple veneer on the plywood that is simply gorgeous.

Second, while both lines feature solid-wood doors, the Wood-Mode line uses furniture grade plywood for the boxes while Brookhaven uses particle board with the option to upgrade to plywood. If you've seen a Wood-Mode cabinet you know that there is a beautiful maple veneer on the plywood that is simply gorgeous.